Introduction

Enhanced Due Diligence (EDD) is a critical component of anti-money laundering (AML) and counter-terrorist financing (CTF) compliance. It involves deeper scrutiny of high-risk customers, transactions, and business relationships to mitigate financial and reputational risks. Regulatory bodies worldwide mandate EDD to prevent illicit financial activities.

What is Enhanced Due Diligence (EDD)?

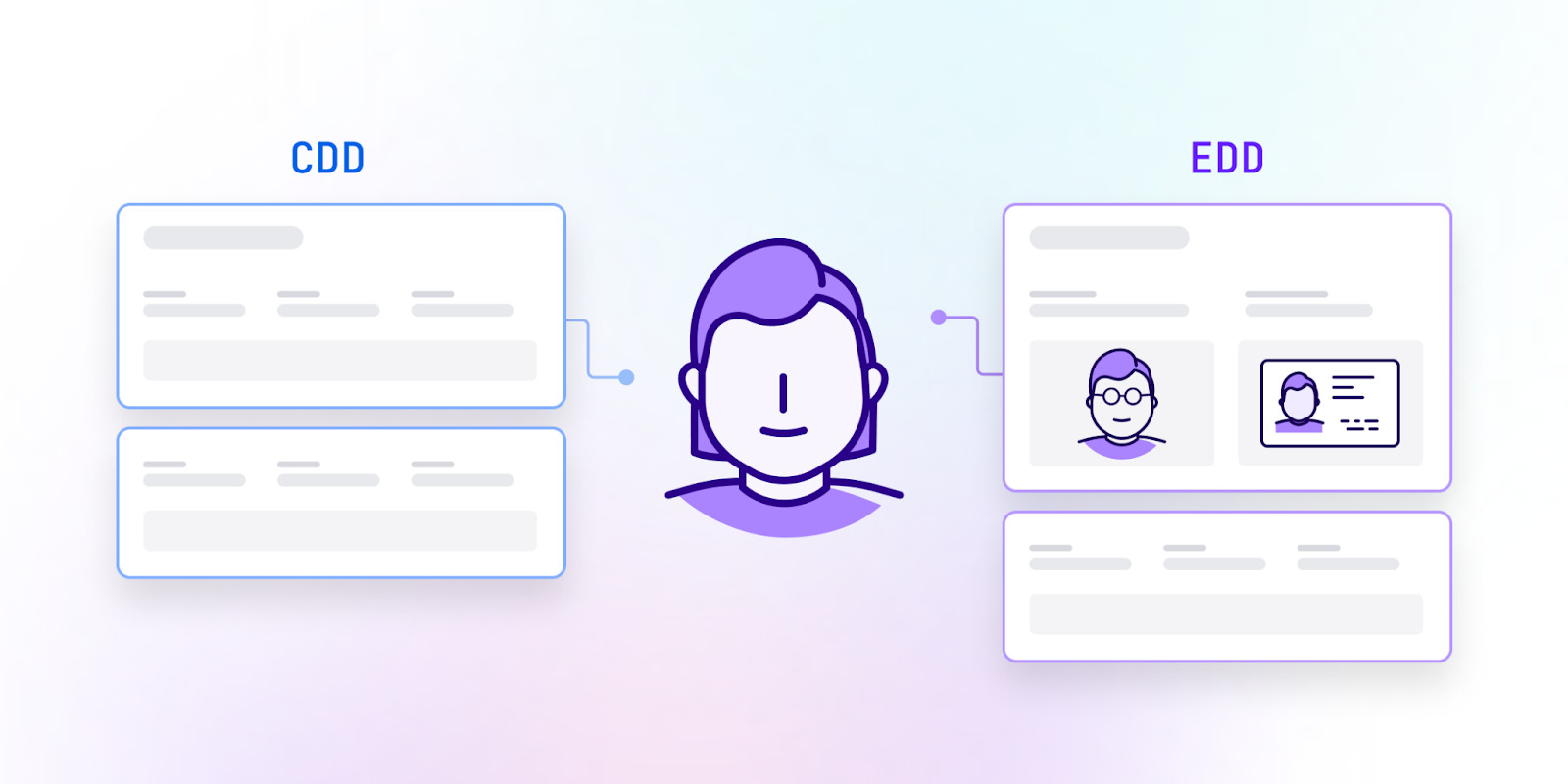

Enhanced Due Diligence is an advanced form of customer due diligence (CDD) that requires financial institutions and businesses to conduct thorough investigations into customers or entities that pose a higher risk. Unlike standard due diligence, EDD includes additional verification measures, continuous monitoring, and in-depth risk assessments.

When is Enhanced Due Diligence Required?

EDD is typically required in the following scenarios:

- High-Risk Customers: Politically exposed persons (PEPs), individuals from high-risk jurisdictions, or those with unusual transaction patterns.

- Large or Complex Transactions: Transactions that exceed regulatory thresholds or involve multiple jurisdictions.

- High-Risk Industries: Sectors prone to money laundering, such as cryptocurrency exchanges, gaming, and shell companies.

- Sanctions Screening: Businesses dealing with sanctioned individuals or entities.

Key Components of Enhanced Due Diligence

1. Customer Identification and Verification

EDD requires collecting additional information beyond basic CDD, including:

- Source of funds and wealth

- Ultimate Beneficial Ownership (UBO) details

- Business operations and financial statements

- Adverse media screening

2. Risk Assessment and Profiling

Businesses categorize customers based on risk levels using factors like:

- Geographic risk (operating in high-risk countries)

- Transaction risk (frequent large transactions)

- Business risk (involvement in cash-intensive sectors)

3. Continuous Monitoring

- Ongoing transaction monitoring for suspicious activities

- Periodic review of customer profiles

- Automated alerts for unusual transactions

4. Regulatory Compliance and Reporting

- Filing Suspicious Activity Reports (SARs) when necessary

- Adhering to guidelines from the Financial Action Task Force (FATF), Financial Crimes Enforcement Network (FinCEN), and other regulators

- Conducting internal audits and training compliance teams

Regulatory Framework for EDD

Global Regulations and Standards

- Financial Action Task Force (FATF): Sets global AML/CTF standards and recommendations.

- European Union (EU) AML Directives: Mandates strict due diligence processes.

- USA PATRIOT Act: Requires enhanced scrutiny for foreign financial institutions.

- UK Money Laundering Regulations: Implements stringent EDD measures for high-risk clients.

Industry-Specific Compliance

- Banking and Finance: Requires thorough risk assessment for clients and transactions.

- Cryptocurrency Platforms: Must verify users and track digital asset transactions.

- Legal and Real Estate Sectors: Involves identifying beneficial ownership in property transactions.

Best Practices for Implementing Enhanced Due Diligence

- Develop a Risk-Based Approach: Tailor EDD procedures based on customer risk levels.

- Use Advanced Technology: AI-driven monitoring tools can detect suspicious activities.

- Train Employees: Regular training ensures compliance with evolving regulations.

- Maintain Comprehensive Records: Document all due diligence processes and findings.

- Collaborate with Regulatory Bodies: Engage with financial watchdogs to stay updated.

Conclusion

Enhanced Due Diligence is a vital safeguard against financial crimes, helping businesses and financial institutions comply with AML regulations while mitigating risks. By implementing a robust EDD framework, organizations can protect their integrity, enhance customer trust, and prevent financial fraud effectively.