If you ask a banker what keeps them awake at night in 2025, it is rarely just market swings or regulatory changes. It is the quiet but constant threat from corners of the internet that most people will never visit. One of those places is Savastan0, a dark web marketplace that is quietly changing the way banks protect your money.

While customers pay bills and transfer funds without a second thought, banks are caught in a nonstop battle with underground marketplaces. Platforms like Savastan0 do more than sell stolen credit cards. They are forcing banks to rethink online banking security in a world where data leaks and stolen credentials are becoming part of daily life.

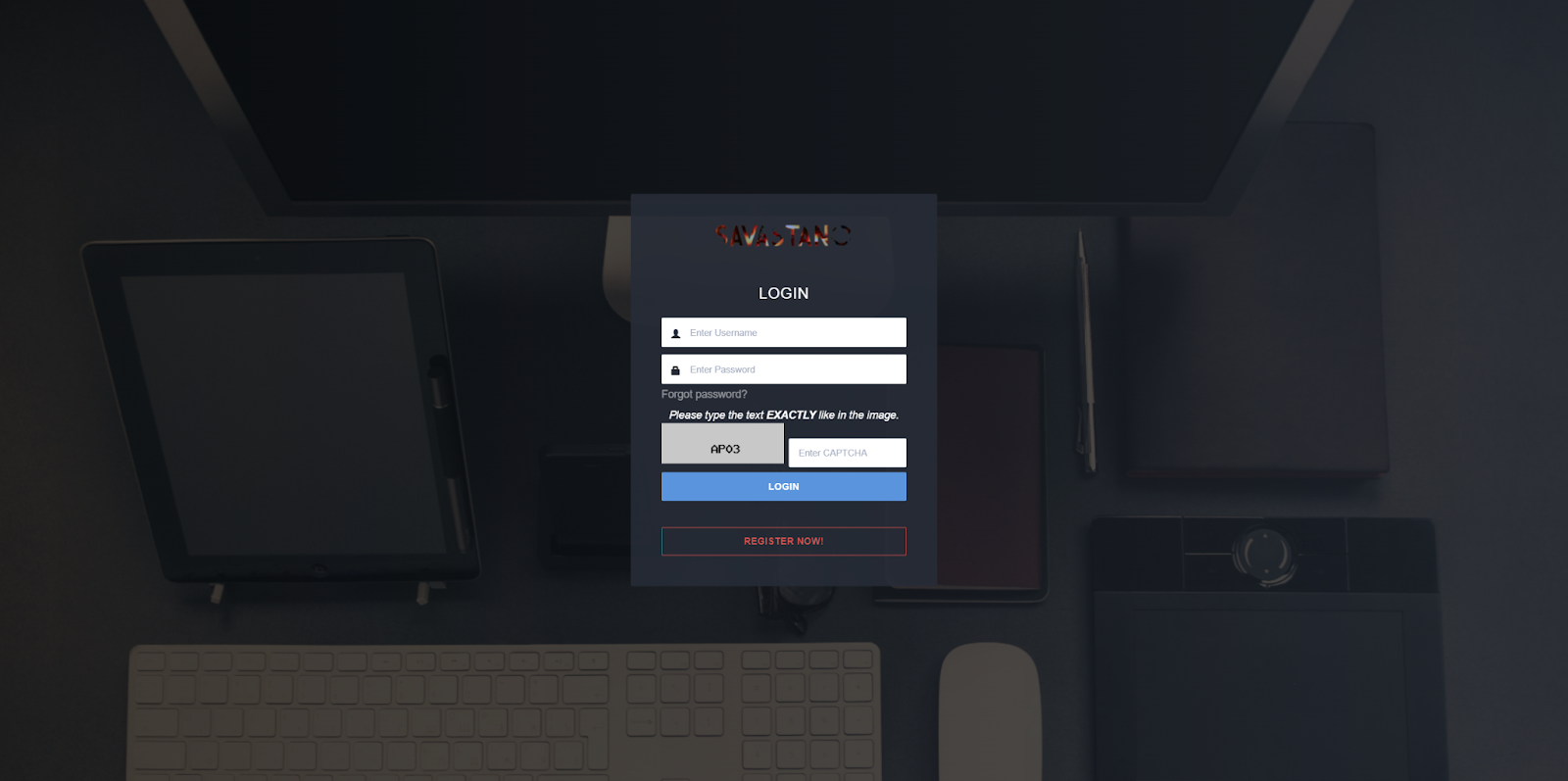

Picture the dark web as a messy maze of hidden sites. In the middle of this chaos, Savastan0 stands out because it feels organized. It is a marketplace where stolen credit card data, personal information, and login credentials are sold with customer support, seller ratings, and escrow services.

In many ways, it operates like any online store, but the product is stolen data.

Because of its structure, even low-level cybercriminals can access this data quickly. That means stolen information can lead to fraudulent transactions within hours of a leak. For banks, it is a nightmare that keeps repeating.

Old fraud detection systems that flagged suspicious transactions after they happened are no longer enough. With credit card data from places like Savastan0 available at any moment, banks have turned to real-time monitoring.

Banks now use artificial intelligence that learns customer spending habits, track devices and locations to catch suspicious logins, and run checks to catch rapid, unusual transactions. Banks have learned they need to move at the pace of cybercrime to protect customers and themselves.

There was a time when an SMS code was enough to protect your bank account. That is no longer the case. With stolen login details from markets like savastan0 cc in circulation, banks have raised their security game.

Many banks now use app-based authentication, biometric checks like fingerprints or facial scans, and even behavioral analytics that study how a user types or moves a mouse. Banks have realized that passwords alone cannot protect customers anymore.

Banks are also investing more in customer education. You might have noticed more emails with tips on avoiding phishing scams or reminders to update your passwords.

This is not just a goodwill gesture. Credential stuffing attacks often succeed because people reuse passwords or cannot spot phishing attempts. Banks know that educating customers is just as important as upgrading their systems.

Many dark web forums vanish quickly, but Savastan0 Shop has lasted by running efficiently. It offers verified sellers, user ratings, and a clean interface that is easy to navigate.

This professional approach to cybercrime means stolen data can be put to use faster. It also means a larger number of people can engage in fraud, testing the defenses banks have in place every single day.

Banks are making significant changes behind the scenes this year.

They are using real-time risk analysis to score every login and transaction for potential threats. They are moving toward zero trust security models that require verification at every step, even for their employees. Banks are also monitoring the dark web, including platforms like Savastan0, to find stolen customer data quickly and take action before the damage spreads.

What once was seen as an optional security upgrade is now necessary for banks to survive and protect their customers.

As banks improve their security measures, dark web marketplaces adapt in response. New phishing kits, malware designed to steal credentials, and social engineering tactics appear as quickly as banks can strengthen their defenses.

Savastan0 has become a testing ground for cybercriminals, which in turn tests the resilience of banks.

While Savastan0 represents a serious threat, it has also pushed banks to improve their security systems. Because of this constant pressure, customers benefit from better security, quicker updates, and smarter protection when managing their money online.

Here’s how you can protect yourself:

✅ Use strong, unique passwords for each account.

✅ Turn on two-factor authentication.

✅ Watch for suspicious emails and login attempts.

✅ Regularly check your statements for unusual activity.

Online banking security is evolving not just because banks want it to but because platforms like Savastan0 leave them with no choice. In the end, this battle means your money and personal information are getting better protection in an increasingly digital world.

Platforms like Savastan0 are changing the rules of cybersecurity, and it pays to stay informed. Knowing how these hidden markets operate and understanding the steps banks take in response will help you protect yourself and your finances in the years ahead.